Distributed Generation Landscape in Pakistan: An Overview

Prosumerism has instilled new hope for addressing challenges surrounding a reliable, affordable, and climate-friendly energy supply. Pakistan – a country with naturally high potential for solar prosumage – also issued net metering regulations in 2015. This brief provides major insights on year-wise, distribution company-wise and finally category-wise Distributed Generation (DG) growth over the past four years. It showcases that distributed generation growth in Pakistan, despite offering one of the most promising solutions to advancing clean energy transition in the country, still is in its infancy. Any significant growth in it will not only contribute to achieving the sustainable development goals on energy and climate action i.e. SDG 7 and SDG 13, but would also dovetail with the country’s quest on energy security. Additionally, It could also play a key role in meeting the ambitious renewable energy target set in the recently introduced ‘Alternate Renewable Energy Policy 2019’.

Download |

1. Introduction

Distributed generation is playing a pivotal role in transitioning to clean energy future. Currently, the global energy sector is undergoing a profound change with the rise of this new class of end-users called ‘Prosumers’.[1] Prosumers are the new active participants in electricity markets, both producing and consuming electricity. As of 2018, the global distributed solar PV capacity additions alone amounted to 43 GW, while Asia dominated this growth.[2] Not to overlook its central role in forecasted global energy transformation, where it is expected to reach 530 GW by 2024—i.e. growing by over 250%.[3]

Pakistan also issued net-metering regulations in 2015.[4] These regulations allowed for on-site renewable systems installations (three-phase connections) by domestic, commercial and industrial end-users with capacities ranging between 1 kW to 1 MW.[5] The net-metering application in Pakistan apply only to two renewable technologies—solar PV and wind turbines. To avail the facility, the consumers initially register their connection with NEPRA, while upon connection, the prosumer automatically enters a seven years purchasing agreement with the relevant DISCO (initially foreseeing a 3 year agreement).[6] Any added surplus energy units to the electricity grid are compensated at off-peak retail tariff. The remuneration scheme under net-metering in Pakistan hence adjusts for net balance—i.e. subtracting amount of electricity consumed from the grid against the units—at the end of every month. The net balance is then reconciled at the end of every month. In the case of positive net balance, the prosumer receives a payment every 3 month, whereas in alternate scenario he/she is charged for the netted amount consumed via monthly billing cycle. In this way, the scheme incentivizes the prosumers through own consumption vis a vis monetizing the surplus fed in the grid.[7]

The concept of on-grid citizen energy generation however is still at its infancy in Pakistan. As of 30th December 2019, cumulative distributed generation installed capacity reached 47.6 MW. This brief has been organized to provide major insights on the growth of Distributed Generation in Pakistan (across the 11 distribution companies).[8] The analysis is based on a complete database covering all installations from the year 2016- 2019.[9] It breaks down the distributed generation growth from standpoint of several dimensions including year-wise distribution of net-metering based installed capacity; distribution company wise progression of net-metering installation; as well as category-wise spread of these installations among different sectors.

2. Distributed Generation in Pakistan: Status and Outlook

As stated earlier, Pakistan enforced regulations on net-metering in 2015. Since Distribution Companies (DISCOs) are the main intermediaries in this entire process—connecting the consumers to the grid— accordingly reference guides were issued to all DISCOs for complying with the net-metering regulations. Following section provides a comprehensive review of distributed generation installed capacity in Pakistan.

2.1. Total Installed Capacity

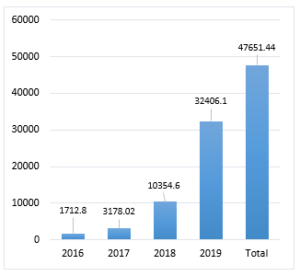

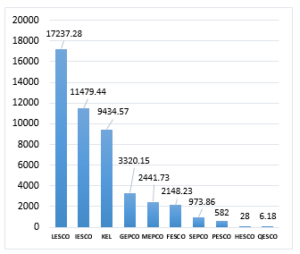

During the past four years, a total of 3020 licenses were issued to distributed generators across the 11 DISCOs. As of December 31, 2019 the cumulative distributed generation installed capacity in Pakistan reached 47,652 kW. Although these regulations applied to both solar PV and wind-turbines, however all installations to-date under these regulations rely on solar PV. Fig.1 illustrates year-wise growth of distributed generation. The horizontal axis shows years of installation whereas vertical axis measures the growth of distributed generation via number of licenses and size of installed capacity (kW). Although overall distributed generation has been registering a positive growth an interesting observation here is the sudden jump in the capacity installations during 2019.

Fig.1 Year-wise Distributed Generation Installed Capacity (kW)

While analyzing these developments, an interesting finding of this study was geographically uneven development of distributed generation across the country. Table.1 illustrates the distribution of total connections vis a vis licenses issued for distributed generation across these DISCOs whereas Fig.2 shows DISCO-wise distribution of installed capacity. If we look at the overall distribution of installed capacity across the 11 DISCOs, it reveals that growth in distributed generation is dominated primarily by LESCO, IESCO and KEL since around 80 percent of installed capacity is concentrated in these three DISCOs. The remainder of the capacity falls under MEPCO, GEPCO, FESCO, SEPCO and PESCO respectively. The distributed generation growth under HESCO and QESCO is negligible as so far the 2 DISCOs have issued 3 and 1 licenses respectively with merely 26 and 6 kilowatts of installed capacity. Finally, TESCO has yet not issued a single license.

Table.1 DISCO-wise Licenses issued to Distributed Generators

|

DISCOs |

Total Connections |

Net-Metering licenses |

|

LESCO |

4598784 |

1005 |

|

IESCO |

2837238 |

975 |

|

KEL |

2583435 |

635 |

|

GEPCO |

3326274 |

140 |

|

MEPCO |

6072783 |

110 |

|

FESCO |

3953132 |

102 |

|

PESCO |

3330907 |

41 |

|

SEPCO |

745308 |

2 |

|

HESCO |

1080714 |

3 |

|

QESCO |

609004 |

1 |

|

TESCO |

442401 |

0 |

Fig.2- DISCO-wise Distributed Generation Installed Capacity (kW)

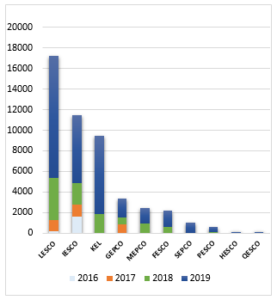

In the year 2016, IESCO and LESCO were the only two pioneering utilities contributing to distributed generation. In 2017, GEPCO became the third utility turning to the distributed generation. KEL, PESCO, MEPCO, FESCO joined in 2018. However, 2019 witnessed the paradigm change wherein not only all DISCOs (except TESCO) started embracing distributed generation but also the installed capacity jumped up from 10,354 kW to 47, 651 kW. Fig.3 illustrates the year-wise installed capacity of distributed generation across the DISCOs.

Fig.3 DISCO-wise and Year-wise Distributed Generation Installed Capacity (kW)

- CATEGORY-WISE TREND OF INSTALLED CAPACITY

Distributed generation offers a host of benefits to different categories of end-users. These include households, commercial, industrial and agricultural as well as public sector entities.

The residential sector is the largest electricity consumer in Pakistan accounting for 45% of total share in electricity consumption. Whereas the share of industry, agriculture and commercial sectors stands at 29%, 8% and 8% respectively.

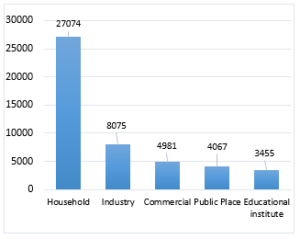

In this section, we analyze the installed capacity of distributed generation category wise. The type of installed capacity is divided into four main categories (a) Households (HH)/Residential sector (b) Industrial sector (c) Commercial sector (d) Educational institutes both public and private including schools, universities (d) Public Spaces (including offices, hospitals and mosques). Mostly the growth in distributed generation is concentrated in the household sector. Industry and commercial sectors are the second and third leading sectors driving this growth. Further an estimated 4052 kW and 3435 kW of capacities are installed respectively by public institutes and educational institutes. Table.2 illustrate the category-wise distribution of distributed generation in Pakistan both in terms of no of licenses issued and installed capacity. Whereas Fig.4 shows the distribution of installed capacity in these different sectors.

Table.2 Category-wise Distributed Generation [10]

|

Type |

Licenses Issued |

Total Installed Capacity (kW) |

|

Residential Sector |

2720 |

27074 |

|

Commercial Sector |

66 |

4981 |

|

Industrial Sector |

60 |

8075 |

|

Public Places |

69 |

4067 |

|

Educational Institutes |

66 |

3455 |

|

Total |

2967 |

47652 |

Fig.4 Category-wise Distributed Generation

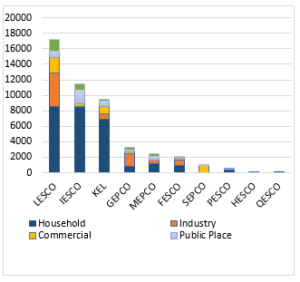

If we breakdown this analysis from standpoint of DISCO wise distribution, household sector dominates distributed generation installment across all DISCOs except in the case of two utilities i.e. GEPCO and SEPCO. GEPCO is the only distribution company, where the installed capacity of the industrial sector is greater than the households sector. LESCO holds the highest installed capacity in the industrial sector.

Fig.5 Category-wise distribution of Installed Capacity (kW)

Table.3 illustrates the mean, median, maximum and minimum installed capacity under different categories. The mean household installed capacity is 9.8 kilowatts which is the lowest among the all types, whereas the mean installed capacity in the industrial sector is 138.50 kW which is the largest observed mean. Maximum installed capacity of commercial, industry and public places is around 1000 kW whereas that of households and educational institutes is 304 kW and 488 kW respectively. Likewise, minimum installed capacity of commercial sector is highest standing at 7.28 kW whereas it is lowest in the case of households standing at 1.06 kW. For all the three remainder sectors namely Industry, Educational institute and Public places, it stands at 3 kW.

Table.3 Summary of Category-wise installed Distributed Generation Capacity (kW)

|

Type |

Mean |

Median |

Max |

Min |

|

Residential Sector |

9.89 |

8.96 |

304 |

1.06 |

|

Commercial Sector |

82.89 |

28 |

998.4 |

7.28 |

|

Industrial Sector |

138.51 |

62.7 |

1000 |

3 |

|

Public places |

59.59 |

23.04 |

1000 |

3 |

|

Educational institutes |

67.37 |

45.5 |

488 |

3 |

3. Conclusion

This brief showcases the distributed generation growth in Pakistan. The analysis reveals that distributed generation in the county is still in its infancy. However, the generation growth has been experiencing a continuous rising trend during the last four years with relatively exponential jump in 2019. Further, mostly this growth tends to be concentrated in 3 utilities namely LESCO, IESCO and KEL yet all utilities have started embracing or at least are in the phase of beginning to embrace it. Finally, although all sectors are engaged in distributed generation yet residential sector remain at the forefront of this drive.

Distributed generation offers one of the most promising solution to advancing clean energy transition in Pakistan. Any significant growth in it will not only contribute to achieving the sustainable development goals on energy and climate action i.e. SDG 7 and SDG 13 but would also dovetail with the country’s quest on energy security. Finally, distributed generation could also play a key role in meeting the ambitious renewable energy target set in the recently introduced ‘Alternate Renewable Energy Policy (2019)’. However, for steering the power sector towards harnessing this immense indigenous renewable potential, maximizing outcomes from this new drive and creating a timely enabling environment aimed at engaging large-scale prosumers is imperative.

*‘Institute of Policy Studies’ is currently working on project aimed at understanding and identifying factors constituting an optimal policy for instigating distributed generation/prosumption in Pakistan. More briefs on the theme area will soon be uploaded.

Prepared by:

Naila Saleh

Research Officer

Institute of Policy Studies (IPS), Islamabad

Sara

Project Assisstant

Institute of Policy Studies (IPS), Islamabad

For queries:

Naufil Shahrukh

General Manager Operations, IPS

naufil@ips.net.pk | www.ips.org.pk

References

[1] Individuals, businesses and energy communities that install renewable energy generation and self-consume some of that generation are called ‘prosumers’. Prosumers may be households; businesses or communities whose primary business is not energy generation.

[2] IEA, Renewables 2018 – Analysis and forecasts to 2023, Organization for Economic Co-operation and Development/International Energy Agency, Paris.

[3] IEA Renewables 2019: Market analysis and forecast from 2019 to 2024, (2019).

[4] NEPRA. ‘Distributed Generation and Net Metering Regulations’, (2015).

[5] ibid

[6] Initially the PPA period was three years, extended to seven years after amendment in the act; NEPRA. (2017b). (ARE) Distributed Generation and Net Metering Regulations, 2015, Amendment-1 vide S.R.O. 1025(1)/2017 (Date: October 10), and, Amendment-2 vide S.R.O. 1261(J)/2017 (Date: December 20).

[7] NEPRA. ‘Distributed Generation and Net Metering Regulations’, (2015).

[8] This analysis excludes 2 small private DISCOs namely DHA-XII (EME Sector) and Bahria Town.

[9] All the statistics throughout the brief have been compiled by the authors from NEPRAs official website.

[10] In terms of no of licenses, 53 observations were dropped owing to missing values on NEPRAs website.