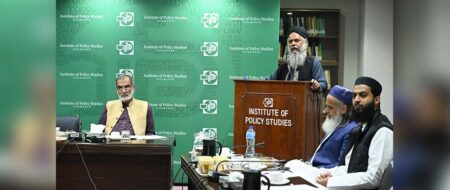

‘1st International Islamic Economics and Development Conference’

QAU conference underscores paradigm shift from Islamic finance to Islamic economics for socio-economic uplift

While Islamic finance has garnered attention in recent years, the true potential lies in developing a comprehensive Islamic economic framework that can uplift Pakistan’s socio-economic landscape by nurturing Islamic social finance and fostering holistic growth. Islamic teachings, rooted in principles aligned with sustainable development goals (SDGs) such as poverty alleviation, equitable growth, and sustainable economic development, offer a comprehensive blueprint for progress.

This was observed by eminent economics experts and practitioners who participated in the one-day hybrid ‘1st International Islamic Economics and Development Conference’ organized on December 7, 2023 by the School of Economics (SoE) Department at Quaid-i-Azam University (QAU) in collaboration with IPS with the theme ‘From Islamic Finance to Islamic Economy’. A number of papers covering a diverse range of topics were also presented at the conference.

The participants included Justice Dr Syed Muhammad Anwer, judge Federal Shariat Court, Dr Muhammad Amjad Saqib, founder, Akhuwat Foundation, Saleem Ahmad Ranjha, founding director Akhuwat Foundation, Zafar-ul-Hassan Almas, joint chief economist, Planning Commission, Dr Ridzwan Bakar, chief executive officer, Yayasan Waqaf Malaysia, Dr Niaz Ahmad Akhtar, vice chancellor QAU, Ambassador (r) Syed Abrar Hussain, vice chairman, IPS, Dr Muhammad Idrees, dean, Faculty of Social Sciences, QAU, Dr Muhammad Tariq Majeed, conference chair and director, SoE, QAU, Dr Muhammad Salman Shaikh, associate professor, Szabist University, and Prof. Anwar Shah, SoE, QAU, among others.

The speakers emphasized that transitioning to an Islamic economy requires a multidimensional approach. Incorporating elements from Islamic teachings and leveraging indigenous models is imperative for sustainable and inclusive development. The reorientation of the economy should extend beyond finance to encompass production, consumption, and distribution systems in resonance with Islamic principles.

Justice Muhammad Anwer highlighted that Islamic social finance is a complete alternate economy, which is staggering in size.

Regarding the transition from Islamic finance to an integrated Islamic economy, he said it demands a paradigm shift in the mindset of stakeholders. This not only necessitates a focus on technicalities but must also overcome institutional inertia and reluctance. He said since 2013, the IMF has been inclusive towards Islamic banking and finance while China is also favorable in this regard. However, the relevant Pakistani institutions do not want to leave their comfort zone.

He said that embracing Islamic economic principles, especially in sectors like banking, requires a gradual yet steadfast approach, and lessons can be drawn from successful models in countries like Malaysia and Indonesia.

The speakers observed that Islamic teachings offer indigenous solutions that resonate with the country’s socio-cultural fabric contrary to Western economic paradigms. They highlighted the pivotal role of societal institutions like family, neighborhood, and religious foundations like mosques and endowments (waqf) in conjunction with the market. Integrating maqasid al-shariah into socio-economic goals underscores the importance of family and collective well-being.

As such, the synergy between market forces and Islamic social finance, including zakat and waqf, is essential for addressing societal challenges and encouraging economic growth. In this regard, the potential of zakat and other overlooked resources, such as mineral wealth, underscores untapped avenues.

Dr Amjad Saqib dispelled the misconception of scarcity of resources, highlighting that the real challenge lies in knowledge utilization. This, in turn, is hindering optimal resource utilization. The crux lies in expanding knowledge horizons to optimize resources and bridge the gap between conventional and Islamic economics. The current scenario underscores a need for transitioning from a consumption-based economy to a production-centric model, ensuring an equitable distribution of resources. He stressed that the source of SDGs should be Islamic teachings that emphasize eradication of poverty, hunger, education for all, and gender equality.

He said there should be a significant emphasis on education and proactive engagement of students in grassroots development models, such as boosting the overall production of a village, to catalyze national progress.

Zafar-ul-Hassan said the imperative for Pakistan lies in harnessing the potential of Islamic social finance, fostering a culture of entrepreneurship, and nurturing an ecosystem conducive to wealth creation through innovation. The youth, armed with new ideas and a proactive approach, can pave the way for economic growth by venturing into entrepreneurship and contributing to the nation’s prosperity.

Meanwhile, challenges like the massive circular debt in the power sector, numbing unemployment, and eye-watering inflation necessitate a comprehensive economic strategy. In this context, he said that while the industrial and other sectors face challenges, the focus should shift towards nurturing a knowledge-based economy, encouraging innovation, and fostering wealth creation among the youth.

The experts opined that creating a culture conducive to entrepreneurship, supported by concepts like qarz-e-hasna, could invigorate the economic landscape. The burgeoning tech sector presents substantial opportunities for youth entrepreneurship.

The conference concluded that transitioning from Islamic finance to an encompassing Islamic economy is pivotal for Pakistan’s economic evolution. Embracing Islamic principles in all facets of economic activities, empowering societal institutions, and nurturing a culture of innovation and entrepreneurship are the keystones for sustainable development. The journey towards an integrated Islamic economy is not only a pathway to economic growth but a reflection of Pakistan’s commitment to holistic prosperity rooted in its rich heritage and Islamic values.